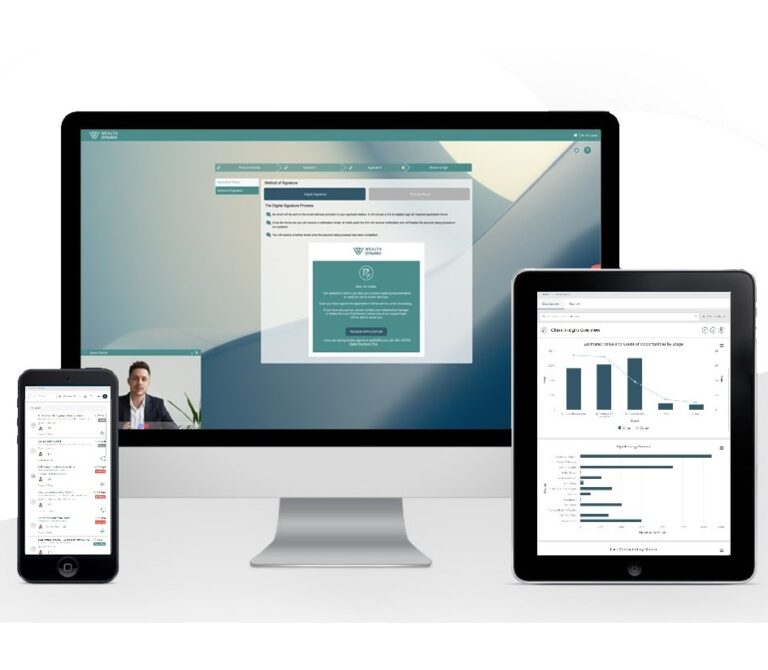

CRM, CLM & Onboarding solutions for private banks & wealth management firms

We support firms across the end-to-end client lifecycle, helping deliver more proactive, efficient and engaging prospecting, onboarding and relationship management, all while remaining fully compliant.

INDUSTRY FOCUSED CRM, ONBOARDING & DIGITAL CAPABILITIES

Our comprehensive client lifecycle management (CLM) platform provides industry-specific capabilities including digital onboarding, client management, CRM and more. Wealth firms globally rely on our technology to help grow and scale their businesses, manage client relationships and streamline operations, all while staying compliant.

Engagement

Support growth with intuitive prospecting tools and embedded advice journeys.

Onboarding

Onboard new clients the same day within a holistic, digital-first platform.

Management

Use our Client Relationship Management (CRM) solution to manage all client types.

Automation

Streamline operational processes with automated workflows and reporting.

Compliance

Embedded 'compliance by design' for regulations including AML and suitability.

Digital

Staff, clients and advisors can all engage and collaborate using digital technologies.

Trusted by renowned global private banks and wealth managers with over $750bn in assets.

Why choose Wealth Dynamix ?

Wealth management is complex and dealing with that complexity can often prove a costly exercise for firms, weighed down by administrative overhead, manual tasks and time-consuming work arounds. Compounding the cost impact of this, front-office staff are so often wrapped up in the process that opportunities to deepen existing client relationships or to develop new ones are not fully realised.

Superior customer experience bears fruit, supporting higher rates of onboarding conversion and client retention, as well as both improved referral rates and wallet share. Achieving this through the use of scalable technology rather than through the force of manpower alone allows revenue to increase without a proportional growth in the cost base, maximising bottom-line profitability and bolstering the long-term prospects of the firm.

In today’s highly competitive environment, firms are looking for ways to delight and surprise their customers – to surpass ever-demanding and continually evolving expectations. To do so, firms must not only be responsive to customer requests, but they must also be proactive with their engagement and efficient in the execution of customer-centric processes. Those that can achieve this will see further support for their top line revenue.

Being compliant is not an afterthought – it is a non-negotiable pre-requisite. Yet the complexity of the regulatory environment and its fast-evolving nature means that compliance often comes at a cost. Firms that are able to meet their regulatory responsibilities – and to evidence that they have done so – in an efficient, low-risk fashion are able to simultaneously reduce ongoing costs and the risk of one-off regulatory fines, whilst simultaneously supporting the ongoing reputation and longevity of their business.

Here’s just some of the recent results our clients have experienced

Recognised by our clients

Wealth Dynamix product built on an industry standard platform

[Microsoft Dynamics] which they tailored for our specific needs and

delivered on time and on budget."

..and by the broader industry

Wealth Dynamix is proud to have received over 40 industry awards

Our modular solutions are the must-have Client Lifecycle

Management platform for success

Leverage the power of Wealth Dynamix CLM solutions to automate manual tasks, to digitise regulations and rulesets and to automatically identify, prioritise and categorise your call to action and notifications. Wealth Dynamix solutions make the complex appear remarkably simple.

Wealth Dynamix solutions provide you with the best of both worlds. Our industry specific, modular CLM can be used immediately as a ‘turn-key’ solution or customised to the nuances of your business operation, the customer journeys and the wider technologies you work with. Furthermore, we offer a full range of deployment options, from on-premises to cloud, to fully managed SaaS. With Wealth Dynamix, the choice is yours.

Process automation is impressive, but Wealth Dynamix solutions are capable of a lot more. Ask the system a query on your data and have it visualise the response, use sentiment analysis to identify opportunities or risks, generate product and service recommendations based upon the goals, needs and interests of your customers, and much more. With Wealth Dynamix, wealth managers and private bankers can operate a hybrid model, using technology to replace manual administrative tasks, creating more time to focus on value-added activities and proactive engagement.

Wealth Dynamix solutions aren’t just functionally rich. They’re easy to use. The core of our philosophy is to deliver solutions people use because they want to, not because they have to – they must be easy on the eye, and even easier to use. For us, innovation is at the heart of what we do. We recognise that optimisation of User Interfaces (UI) and User Experience (UX) is a journey that never ends. We are constantly striving for perfection.

Your customers are your most valuable asset and keeping their data safe and secure is of the highest priority. Our solution’s architecture is configured with a ‘no compromise’ approach to security. So you can rest assured that your customer data is protected with state-of-the-art technologies and that we’ll always remain one step ahead. Our software can be delivered either in the public cloud, within your private cloud or on-premises, and our security-first approach supports a full range of encryption and tokenisation options.

Delivered and supported by our wealth management industry experts

Experts in wealth management

We are much more than just a technology provider. We recognise that to be leaders in wealth-specific technology you need to first be experts in the industry. With a staff base that brings executive-level experience from well-known financial institutions, when we say we’ve walked in your shoes, we mean it. Couple that experience with those who have worked at some of the best-known consultancies and with our technical know-how, and we can say, with confidence, that we don’t think you will find a more complete partner to help you reach your goals.

Specialists in business change and adoption

We understand the challenges that change can bring. That is why we have designed delivery processes that work in harmony with the change management process. Don’t just take our word for it. Take the word of our clients, who range from global Tier 1 companies with multi-jurisdictional deployments, to single location boutiques and challenger banks.

A wealth platform that integrates with your

existing systems? Look no further.

From technology vendors to the Microsoft framework and your back-office platforms, Wealth

Dynamix’s open ecosystem integrates seamlessly with over 40 different systems. Talk to us about how

we can make your wealth management processes smoother with your existing software.

Speak with an expert

LATEST INSIGHTS

17 April 2024

Achieving profitability at scale: the potential for AI

We delve into the use of AI technology in wealth management. Far from belonging to a far-distant future, it is here and growing more intelligent by the day.

5 min. read

2 April 2024

Empowering client-facing relationship managers and advisors: Perspectives from Wealth Dynamix’s APAC head

Hubbis recently hosted a digital dialogue focusing on the application of the latest digital solutions for the Relationship Managers and advisory in the world of Asian wealth management, as technology revolutionises the offerings and efficiencies across the broad wealth management community in the region.

5 min. read

21 March 2024

Wealth Dynamix welcomes Luna Investment Management as a new client, empowering proactive Client Relationship Management and regulatory compliance

Wealth Dynamix, a leading provider of Client Lifecycle Management solutions for private banks and wealth managers, announced Luna Investment Management as a new client as part of our partnership with Third Financial.

3 min. read